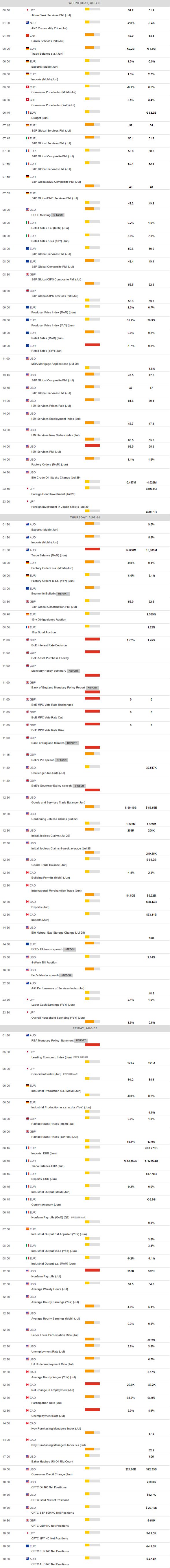

Daily Market Updates

03 Aug 2022

EURUSD

EUR/USD came under strong selling pressure and dropped to the 1.0170 region, totally eroding the early attempt to revisit the 1.0300 yardstick.

Indeed, the resurgence of the risk-off sentiment lent much needed oxygen to the greenback and motivated the US Dollar Index (DXY) to reverse course and rebound from the early drop to the boundaries of 105.00 to the area north of the 106.00 hurdle.

Geopolitical jitters around the trip of the US House of Representatives Speaker Nancy Pelosi to Taiwan amidst rising warnings from China have sparked the resumption of the risk aversion in the global markets, helping the buck reclaim part of the ground lost as of late and extend the decline in US yields for yet another session.

Supporting the upside in the dollar appeared the sudden rebound in US yields across the curve and comments from Chicago Fed C.Evans advocating a 50 bps rate hike in September, although not ruling out a 75 bps hike, all depending on the inflation performance. His colleague at the Cleveland Fed L.Mester said in an interview that inflation has not decreased at all, at a time when she suggested that there is no recession at the moment.

There were no meaningful data releases in both the US and euro calendars on Tuesday.

EUR/USD now needs to surpass the so far August top at 1.0293 (August 2) to spark a more serious rebound. Against that, the 55-day SMA at 1.0422 lines up as the next up barrier seconded by the 6-month resistance line near 1.0450. Above this region, the selling pressure around the pair is seen diminishing and this could allow a probable visit to the weekly high at 1.0615 (June 27) prior the June peak at 1.0773 (June 9) and the May top at 1.0786 (May 30). In the opposite direction, the loss of the weekly low at 1.0096 (July 27) could open the door to a deeper retracement to the parity level ahead of the 2022 low at 0.9952 (July 14) and seconded by the December 2002 low at 0.9859. The daily RSI ticks lower to the sub-45 zone.

Resistance levels: 1.0293 1.0462 1.0488 (4H chart)

Support levels: 1.0171 1.0145 1.0113 (4H chart)

USDJPY

After bottoming out in fresh 2-month lows near 130.40, USD/JPY made a violent U-turn and advanced to the boundaries of the 133.00 mark in tandem with the almost-equally abrupt change of direction in US yields.

Indeed, US yields across the curve reversed part of the recent weakness and printed decent rebounds after hitting fresh multi-week lows earlier in the session on Tuesday.

Adding to the pair’s upside bias, the US dollar appeared well underpinned by the reappearance of the risk aversion among investors, all in response to renewed jitters around US and China after N.Pelosi’s trip to Taiwan.

In Japan, the 10y JGB Auction turned up at 0.168% (from 0.248%) in what was the only event in the domestic calendar.

Extra losses in USD/JPY should break below the so far August low at 130.39 (August 2). This area of support looks reinforced by the 100-day SMA (130.21) and precedes the psychological 130.00 mark. Down from here emerges the May low at 126.36 (May 24) prior to the key 200-day SMA at 122.42. On the other hand, the 55-day SMA at 133.82 should offer initial resistance before the weekly top at 137.46 (July 27) and the post-BoJ peak at 138.87 (July 21). Further upside could see the 2022 high at 139.38 (July 13) revisited ahead of the round level at 140.00. The daily RSI bounces past the 38 level.

Resistance levels: 132.92 134.59 136.09 (4H chart)

Support levels: 130.39 129.51 126.55 (4H chart)

GBPUSD

The resumption of the risk aversion motivated market participants to shift their inflows into the greenback in detriment of the risk complex, forcing GBP/USD to trim part of Monday’s strong advance to the boundaries of the 1.2300 mark.

Indeed, US-China effervescence grabbed all the attention in light of the visit of the US House of Representatives Speaker Nancy Pelosi to Taiwan, reigniting the demand for the safe haven space.

On the back of the latter, UK debt markets saw another daily decline in the UK 10y Gilt yields, this time to levels last traded in mid-May near 1.70%.

Data wise in the UK, the Nationwide Housing Prices expanded at an annualized 11% in July and 0.1% from a month earlier.

The surpass of the so far August high at 1.2293 (August 1) should motivate GBP/USD to attempt a move to the weekly peak at 1.2332 (June 27) prior to another weekly top at 1.2405 (June 16). North from here turns up the 100-day SMA at 1.2506 ahead of the 1.2666 level (May 27 high), which is deemed as the last defense for an assault of the psychological 1.3000 mark. In case bears regain control of the sentiment, there are no contention level of note until the 2022 low at 1.1759 (July 14), which precedes the 2020 low at 1.1409 (March 20). The daily RSI comes under pressure and approaches 56.

Resistance levels: 1.2293 1.2332 1.2405 (4H chart)

Support levels: 1.2175 1.2079 1.2020 (4H chart)

AUDUSD

AUD/USD reversed the optimistic start of the week and returned to the sub-0.7000 region on Tuesday, ending the session with strong losses despite the RBA raised the policy rate as expected.

In fact, the RBA hiked the OCR by 50 bps to 1.85%, matching the broad consensus. Governor Lowe left the door open to the continuation of the normalization process via interest rate hikes, although he stressed that the size would depend on incoming data. In addition, the central bank revised up its forecasts for inflation and now sees the CPI at 7.75% this year, 4.0% in 2023 and 3.0% in 2024.

The renewed buying bias in the greenback coupled with the US-China-led risk aversion played against the continuation of the recovery in the pair and kept the commodity space depressed. On the latter, prices of the iron ore retreated for the third session in a row, albeit marginally this time, and tested the $110.00 region per tonne.

Other than the RBA event, the Aussie calendar saw Home Loans contract at a monthly 3.3% in June and investment Lending for Homes shrink 6.3% in the same period.

The resumption of the bullish mood should motivate AUD/USD to challenge the so far August high at 0.7047 (August 1) ahead of the weekly peak at 0.7069. The breakout of this level should unveil a probable visit to the temporary 100-day SMA at 0.7115, just ahead of the key 200-day SMA at 0.7167 and prior to the June top at 0.7282 (June 3). If sellers push harder, the immediate support emerges at the 2022 low at 0.6681 (July 14) before the May 2020 low at 0.6372 (May 4) and the weekly low at 0.6253 (April 21 2020). The daily RSI loses ground and trades close to 51.

Resistance levels: 0.6966 0.7047 0.7069 (4H chart)

Support levels: 0.6911 0.6889 0.6878 (4H chart)

GOLD

Gold prices edged higher for the fifth consecutive session despite the firmer note around the greenback and the rebound in US yields across the curve.

However, the demand for the yellow metal was sustained by increasing risk aversion emanating from N. Pelosi’s visit to Taiwan along with persistent threats from the Chinese government.

Gold trades closer to the critical $1,800 mark, which remains reinforced by the 55-day SMA. If bullion clears this key hurdle, then the next key level should emerge at the 200-day SMA at $1,842, which is closely followed by the 100-day SMA at $1,849 and the $1,857 level (June 16 high). Immediately to the downside appears the weekly low at $1,711 (July 27) prior to the 2022 low at $1,680 (July 21). A drop below this area exposes the 2021 low at $1,1676 (March 8) ahead of the June 2020 low at $1,670 (June 5).

Resistance levels: $1,788 $1,814 $1,825 (4H chart)

Support levels: $1,752 $1,711 $1,680 (4H chart)

CRUDE WTI

Prices of the barrel of the WTI partially recovered ground lost on Monday and advanced past the $96.00 mark on Tuesday, reversing the initial decline to the vicinity of the $92.00 yardstick.

Tuesday’s uptick in crude oil prices came on the back of the resumption of supply concerns ahead of the key OPEC+ meeting on Wednesday. On this, and according to CME Group’s OPEC Watch Tool, the probability that the cartel could maintain the current output increase is almost 90% vs. a nearly 6% probability of further boost to oil production.

Later on Tuesday, the API will report on US crude oil inventories in the week to July 29 (-500K barrels exp.)

Immediately to the downside for WTI emerges the August low at $92.44 (August 1) ahead of the July low at $90.58 (July 14). The loss of the latter could lead up to a deeper pullback to the 81.94 level (low January 24) ahead of the 2022 low at $74.30 (January 3). On the other hand, the weekly top at $101.87 (July 29) is expected to rise as the next up barrier before the weekly peak at $104.44 (July 19) and the July high at $111.42 (July 5). North of here aligns the weekly peak at $114.00 (June 29) seconded by the June top at $123.66 (June 14) and the 2022 high at $129.42 (March 8).

Resistance levels: $96.41 $101.87 $104.44 (4H chart)

Support levels: $92.42 $90.54 $89.00 (4H chart)

DOW JONES

US stocks tracked by the Dow Jones added to the pessimism seen at the beginning of the week and retreated to 3-day lows near the 32,400 region on turnaround Tuesday.

Indeed, equities suffered the investors’ preference for the safe haven universe on the back of the comeback of risk aversion, particularly following N.Pelosi's trip to Taiwan.

In addition, market participants extended their concerns over the health of the US economy, especially after advanced GDP figures released last week showed a technical recession in the April-June period.

Against that, the Dow Jones retreated 0.82% at 32,531, the S&P500 dropped 0.29% at 4,107 and the tech-benchmark Nasdaq Composite shed 0.21% at 12,342.

Dow bulls continue to target the so far August high at 32,972 (August 1) before the June peak at 33,272 (June 1). Once cleared, the index could attempt a visit to the May top at 34,117 (May 4) prior to the April high at 35,492 (April 21). The next magnet for sellers, in the meantime, emerges at the weekly low at 31,705 (July 26) ahead of the July low at 30,143 (July 14) and the 2022 low at 29,653 (June 17). The loss of the latter could pave the way for a subsequent drop to the 28,902 level (low November 12 2020) seconded by the October 2020 low at 26,143 (October 30). The RSI loses the grip and retreats below 61.

Top Performers: Travelers, Walmart, J&J

Worst Performers: Caterpillar, Boeing, Intel

Resistance levels: 32,972 33,272 34,117 (4H chart)

Support levels: 32,422 31,705 31,534 (4H chart)

-637950626726998464.png)

-637950627473927856.png)

-637950627095893729.png)

-637950627826283030.png)

-637950628140934465.png)

-637950628866770945.png)

-637950629548686595.png)