Daily Market Updates

28 Sep 2022

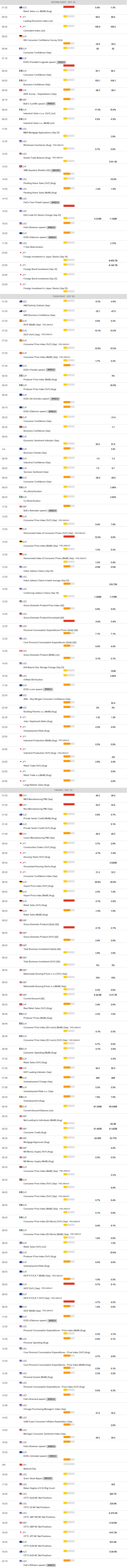

EURUSD

The joy around EUR/USD only lasted a few hours.

Indeed, dip-buyers turned up and encouraged spot to surpass the 0.9600 barrier earlier on turnaround Tuesday, although that optimism died off later in the session pari passu with the re-emergence of the bid bias around the buck.

The sixth straight decline in the pair was against the backdrop of the generalized worsening in the risk-associated universe and the continuation of the uptrend in yields on both sides of the Atlantic, with the exception of the US 2-year note.

In the US, Consumer Confidence tracked by the Conference Board improved to 108.0 in September and Durable Goods Orders contracted at a monthly 0.2% in August. Finally, the FHFA House Price Index dropped 0.6% MoM in July and New Home Sales expanded 28.8% MoM in August, or 0.685M units.

Further weakness in EUR/USD remains well in store for the time being and the breakdown of the 2022 low at 0.9552 (September 26) should expose the round level at 0.9500 prior to the weekly low at 0.9411 (June 17 2002). On the flip side, the initial up barrier remains at the weekly high at 1.0050 (September 20) just before the 55-day SMA at 1.0060. Further up aligns the 7-month resistance line near 1.0100. A close above the latter is needed to allow for further recovery to, initially, the September top at 1.0197 (September 12) ahead of the 100-day SMA at 1.0263 and the August peak at 1.0368 (August 10). The daily RSI remained in the oversold territory, although it rebounded to the vicinity of 28.

Resistance levels: 0.9670 0.9701 0.9774 (4H chart)

Support levels: 0.9584 0.9552 0.9411 (4H chart)

USDJPY

USD/JPY traded without a clear direction, although it managed well to keep business above the 144.00 mark on Tuesday.

Indeed, the pair rebounded from daily lows on the back of the late recovery in the dollar and in response to the continuation of the upside bias in the 10-year and 30-year bond yields, which managed to reverse the initial pessimism.

Following last week’s BoJ/MoF FX intervention, Japanese finmin Suzuki reiterated that they continue to closely follow developments in the FX markets.

There were no data releases in the Japanese calendar on Tuesday.

The continuation of the uptrend in USD/JPY stays focused on the 2022 high at 145.90 (September 7) ahead of the August 1998 top at 147.67 (August 11 1998) and the August 1990 peak at 151.65. On the other hand, the post-intervention low at 140.34 (September 22) emerges as the initial target for bears prior to the temporary 55-day SMA at 138.36 and the weekly low at 135.80 (August 23). South from here comes the 100-day SMA at 135.71 before the weekly low at 131.73 (August 11) and the August low at 130.39 (August 2). The daily RSI looked stable around 65.

Resistance levels: 144.85 145.90 146.97 (4H chart)

Support levels: 143.50 141.76 140.34 (4H chart)

GBPUSD

GBP/USD rebounded markedly and briefly traded above the 1.0800 mark on Tuesday after bottoming out in fresh all-time lows near 1.0350 at the beginning of the week.

In fact, the initial corrective retracement in the greenback lent much-needed oxygen to the risk complex and motivated the sterling to reverse five sessions in a row and closed around Monday’s levels. It is worth noting that cable closed with gains in only one month (May) since the beginning of the year.

BoE’s H.Pill spoke earlier on Tuesday and suggested that there was a significant increase in assets repricing following Chancellor Kwarteng’s announcements. He added that the BoE must incorporate market movements in the monetary policy outlook and hinted at the idea that the bank will need a significant monetary policy response.

Looking at the broader picture, the quid is expected to remain under scrutiny on the back of the gloomy outlook for the UK economy coupled with the fragile political environment and the promise of further tightening by the BoE.

The British pound risks extra decline in the very near term. Against that, there is still scope for GBP/USD to slip back to the all-time low at 1.0356 (September 26). Conversely, occasional bullish attempts should meet the next barrier not before the weekly high at 1.1460 (September 20) ahead of the September top at 1.1738 (September 13). Further up comes the 55-day SMA at 1.1768 before the weekly peak at 1.1900 (August 26). The daily RSI bounced back and regained the 18 level and above, still well deep into the oversold territory.

Resistance levels: 1.0837 1.0930 1.1225 (4H chart)

Support levels: 1.0631 1.0356 (4H chart)

AUDUSD

AUD/USD extended the bearish move to the proximity of the 0.6400 neighbourhood for the first time since May 2020 on Tuesday.

The greenback left behind the initial selling bias and regained buying pressure, forcing the Aussie dollar and the rest of its risky peer to reverse gear and return to the negative territory.

Collaborating with the downside appeared the generalized negative performance in the commodity space, where copper prices saw their decline accelerate to multi-week lows while iron ore extended further the consolidative mood, always below the $100.00 per tonne.

There were no results in the Australian docket on Tuesday, whereas flash Retail Sales will take centre stage on Wednesday.

A deeper drop in AUD/USD should refocus on the May 2020 low at 0.6372 (May 4) ahead of the weekly low at 0.6253 (April 21 2020). In the opposite direction, there are minor resistance levels at 0.6747 (September 20) and 0.6770 (September 15) ahead of the 55-day SMA at 0.6852 and the September high at 0.6916 (September 13). Further up aligns the interim 100-day SMA at 0.6914, which precedes the psychological 0.7000 mark. The daily RSI deepened further into the oversold territory near 25.

Resistance levels: 0.6512 0.6533 0.6670 (4H chart)

Support levels: 0.6420 0.6402 0.6378 (4H chart)

GOLD

Despite the continuation of the upside in the greenback, prices of the yellow metal charted decent gains and set aside three consecutive sessions with losses on turnaround Tuesday.

Other than dollar strength, US yields in the belly and the long end of the curve reversed the initial knee-jerk and resumed the strong upside to the vicinity of the 4.00% mark and near 3.85%, respectively. Higher yields and hawkish comments from Fed’s Evans in the meantime, limited the upside in bullion to the $1,640 region as well.

The 2022 low at $1,621 (September 26) emerges as the immediate support ahead of the round level at $1,600 and the April 2020 low at $1,572 (April 1). On the contrary, the weekly high at $1,688 (September 21) is expected to offer initial hurdle prior to the September top at $1,735 (September 12). The surpass of this level could open the door to the $1,765 level (August 25) just ahead of the 100-day SMA at $1,770 and the August peak at $1,807 (August 10).

Resistance levels: $1,649 $1,688 $1,707 (4H chart)

Support levels: $1,621 $1,606 $1,572 (4H chart)

CRUDE WTI

Supply concerns returned to the fore and lifted spirits among traders on Tuesday, triggering a corrective upside in prices of the WTI to the vicinity of the key $80.00 mark per barrel after two pullbacks in a row.

Indeed, prices rose in anticipation of potential supply curbs in the Gulf of Mexico prior to Hurricane Ian, while speculation that the OPEC+ could announce a reduction in crude oil output at its meeting on October 5 also collaborated with the daily uptick.

Later on Tuesday, the API will report on the US crude oil supplies in the week to September 23 ahead of the DoE report on Wednesday.

WTI faces the next support at the September low at $76.28 (September 26) prior to the 2022 low at $74.30 (January 3). If cleared, then the focus of attention should gyrate to the weekly low at $66.15 (December 20 2021) ahead of the December 2021 low at $62.46 (December 2). Bulls, in the meantime, initially target the minor hurdle at the weekly top at $86.66 (September 21) before another weekly peak at $90.17 (September 14), which appears closely followed by the September high at $90.37 (September 5). The breakout of this level could put the 200-day SMA at $97.43 back on the traders’ radar prior to the weekly top at $97.65 (August 30) and the psychological $100.00 mark.

Resistance levels: $80.29 $85.98 $86.66 (4H chart)

Support levels: $76.23 $74.26 $72.55 (4H chart)

DOW JONES

Another day, another low in US equities, as the spectre of the bear market continued to hover among market participants.

In fact, recession fears coupled with the likelihood of a global slowdown kept doing the rounds on Tuesday and maintained the sentiment among investors well depressed.

Adding fuel to the fire, FOMC’s N.Kashkari saw risks of overdoing the normalization process, as he considered the Fed to be moving very aggressively. In addition, his colleague J,Bullard noted that there is a risk of recession if the US economy is hit by unexpected macroeconomic shocks.

That said, the Dow Jones dropped 0.71% to 29,050, the S&P500 retreated 0.56% to 3,634 and the tech-heavy Nasdaq Composite lost 0.49% to 10,748.

The Dow Jones charted a new YTD low at 28,958 (September 27) and now appears vulnerable to a drop to the weekly low at 28,902 (November 12 2020) prior to the October 2020 low at 26,143 (October 30). The initial up barrier emerges at the weekly top at 31,026 (September 19) seconded by the September peak at 32,504 (September 12) and the 33,364 level (August 26), which remains propped up by the key 200-day SMA at 33,305. Up from here turns up the August high at 34,281 (August 16) ahead of the April top at 35,492 (April 21). The daily RSI fell further into the oversold territory and flirted with 24.

Top Performers: Home Depot, Salesforce Inc, Apple

Worst Performers: McDonald’s, Walt Disney, Procter&Gamble

Resistance levels: 31,026 31,941 32,504 (4H chart)

Support levels: 28,958 28,902 26,143 (4H chart)

-637999022886864428.png)

-637999023637823914.png)

-637999023290597444.png)

-637999023958546260.png)

-637999024253531536.png)

-637999024846225489.png)

-637999025188775243.png)