Daily Market Updates

14 Nov 2022

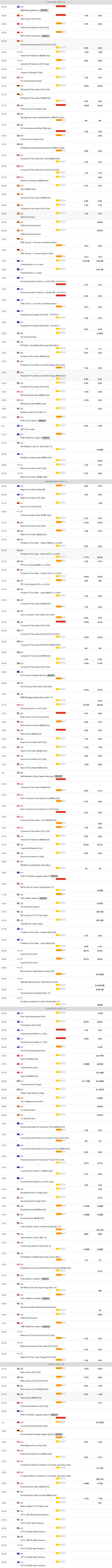

EURUSD

EUR/USD’s rally remained unabated on Friday and extended the post-US CPI optimism that blossomed in the second half of the week. Indeed, the pair rose to levels last traded back in mid-August and poked with highs seen in that month past 1.0360, always on the back of the pronounced sell-off in the dollar.

In fact, the dollar remained in free fall and tumbled to fresh 3-month lows in the 106.40 region, as market participants continued to reprice a potential Fed’s pivot in the next months, and likely to be debated at December's FOMC gathering.

In line with the uptick in the pair, the German 10-year bund yields reversed three daily pullbacks in a row and edged higher past the 2.15% level.

From the ECB’s backyard, Vice-President de Guindos suggested that a technical recession looks very likely and added that markets overreacted to positive US inflation figures.

Data wise in the old continent, final inflation figures in Germany saw the CPI rise 10.4% YoY and 0.9% vs. the previous month. In addition, the European Commission published its updated forecasts and now sees the EMU’s GDP contracting in Q4 2022 and Q1 2023 and returning to positive growth in Q2 2023. Furthermore, the Euroland is expected to expand 3.2% this year, 0.3% in 2023 and 1.5% in 2024. Regarding inflation, the CPI in the region is predicted to rise 8.5% in 2022, 6.1% in 2023 and 2.6% in 2024.

In the US, the preliminary Michigan Consumer Sentiment is expected to worsen to 54.7 for the month of November, while the 5 Year Inflation Expectations ticked higher to 3.0% (from 2.9%).

The continuation of the uptrend in EUR/USD now meets the next resistance at the August high at 1.0368 (August 10) ahead of the critical 200-day SMA, today at 1.0438. North from here comes the weekly top at 1.0614 (June 27). By contrast, there is an initial support at the temporary 100- and 55-day SMAs at 1.0030 and 0.9899, respectively, prior to the weekly low at 0.9730 (November 3). The loss of this level could put a potential test of another weekly low at 0.9704 (October 21) back on the traders’ radar before the October low at 0.9631 (October 13). The daily RSI approached the overbought level past 68.

Resistance levels: 1.0364 1.0448 1.0488 (4H chart)

Support levels: 0.9935 0.9860 0.9730 (4H chart)

USDJPY

Another negative session in the dollar sponsored the second consecutive daily decline in USD/JPY, this time revisiting the 138.50 region for the first time since late August.

In fact, the acute sell-off in the greenback remained everything but abated for the second day in a row against the backdrop of increasing speculation that the Federal Reserve could slow the pace of its normalization process in the next months. This view has been particularly exacerbated following lower-than-expected US inflation figures during October and published earlier in the week.

All in all, spot closed the 4th consecutive week with negative figures and it has so far halted three monthly gains in a row.

In Japan, Producer Prices rose 0.6% MoM in October and 9.1% over the last twelve months.

The pronounced drop in USD/JPY now puts a probable visit to the weekly low at 135.80 (August 23) back on the radar ahead of the key 200-day SMA at 132.60 and the August low at 130.39 (August 2). On the other hand, the 55-day SMA at 144.83 should offer interim hurdle prior to the weekly high at 148.84 (October 31) and the 2022 top at 151.94 (October 21). The daily RSI dropped to the oversold territory for the first time since November 2020 near 27.

Resistance levels: 142.48 146.57 146.79 (4H chart)

Support levels: 138.45 138.05 136.19 (4H chart)

GBPUSD

Indeed, the generalized upbeat sentiment in the risk-associated universe lent further support to the sterling and sponsored the second daily advance in a row and helped the pair reverse the negative performance of the previous week.

From the BoE, MPC (dove) member S.Tenreyro warned against over-tightening the policy and suggested that the monetary conditions would have to loosen maybe in 2024 to try to prevent inflation from falling below the bank’s target. She also hinted that the UK economy might enter recession in Q4 2022 mostly due to lower real incomes.

In the UK calendar, September data showed the GDP 3-Month Average contracted 0.2%, the flash GDP Growth Rate expanded 2.4% YoY and the GDP increased 1.3% from a year earlier. Finally, the NIESR Monthly GDP Tracker contracted 0.2% for the month of October.

In case bulls push harder, GBP/USD could challenge the weekly high at 1.1900 (August 26) in the near term ahead of the psychological 1.2000 mark and the August top at 1.2293 (August 1). In the opposite direction, there is an interim contention at the 55-day SMA at 1.1359 prior to the November low at 1.1142 (November 4). A deeper pullback could motivate the weekly low at 1.1059 (October 21) to re-emerge on the horizon ahead of the October low at 1.0923 (October 12). The daily RSI advanced further and flirted with 62.

Resistance levels: 1.1854 1.1900 1.2142 (4H chart)

Support levels: 1.1333 1.1302 1.1142 (4H chart)

AUDUSD

In line with the rest of the riskier assets, the Aussie dollar extended its gain vs. the greenback and lifted AUD/USD to new multi-week peaks north of 0.6700 the figure on Friday.

Indeed, the second daily advance in the pair was also bolstered by the broad-based positive performance in the commodity complex, with copper prices and the iro ore both posting humble gains.

Extra support for AUD came from the daily uptick in the AGB 10-year yields to the vicinity of 3.70%, reversing at the same time three daily drops in a row,

There were no data releases Down Under on Friday, leaving all the attention to Tuesday’s release of the RBA Minutes of the November gathering.

Considering the recent price action, AUD/USD now faces the immediate barrier at the 7-month resistance line near 0.6750. The breakout of this region should put the pair en route to extra gains to, initially, the September peak at 0.6916 (September 13) just followed by the psychological 0.7000 mark. Just the opposite, the weekly low at 0.6386 (November 10) emerges as the next area of contention ahead of the November low at 0.6272 (November 3) and the 2022 low at 0.6169 (October 13), all preceding the psychological 0.6000 yardstick. The daily RSI edged further up and approached 65.

Resistance levels: 0.6716 0.6747 0.6770 (4H chart)

Support levels: 0.6386 0.6272 0.6210 (4H chart)

GOLD

The dollar’s collapse encouraged bulls to remain in control of the sentiment around the yellow metal and lift prices to new 3-month tops past the $1,770 level per ounce troy at the end of the week.

Indeed, bullion extended the rebound amidst rising speculation of a Fed’s pivot in its current normalization process and in response to heightened weakness in the dollar, which eventually dragged the USD Index (DXY) to new multi-week lows.

The precious metal, in the meantime, closed the second consecutive week with gains, advancing past the 200-week SMA ($1,693) and returning to levels last seen in mid-August. Furthermore, gold has already gained nearly 10% since the November low at $1,616 (November 3)

Gold printed a new monthly high at $1,772 on November 11. If it extends the rebound, then it could dispute the critical $1,800 zone ahead of the key 200-day SMA at $1,803 and the August top at $1,807 (August 10). On the contrary, temporary support levels come at the 55- and 100-day SMAs at $1,715 and $1,678, respectively, prior to the 2022 low at $1,614 (September 28). The breach of the latter could put a probable visit to the round level at $1,600 back on the traders’ radar ahead of the April 2020 low at $1,572 (April 1).

Resistance levels: $1,772 $1,782 $1,807 (4H chart)

Support levels: $1,702 $1,669 $1,616 6 (4H chart)

CRUDE WTI

News that China could curb its COVID restrictions in the short term bolstered Friday’s uptick in prices of the WTI, although they could not sustain the move to the $90.00 mark per barrel. The commodity, in the meantime, closed the first week with losses after two consecutive weekly gains.

The weaker note in the greenback collaborated as well with the upside momentum in crude oil, while rising cautiousness from the OPEC+ ahead of its December meeting also seem to have propped up the upbeat mood.

In the calendar, driller Baker Hughes said the US oil rig count increased by 9 in the week to November 11, taking the total US active oil rigs to 622.

WTI continues to face the initial up barrier at the November peak at $93.73 (November 7) ahead of the weekly high at $97.65 (August 30). The surpass of the latter could prompt the key 200-day SMA at $98.39 to resurface on the horizon before the psychological $100.00 mark per barrel. On the flip side, the November low at $84.74 (November 10) should hold the initial downside prior to the weekly low at $82.10 (October 18) and the key $80.00 mark. If the WTI breaks below the latter it could put a test of the minor support at $79.16 (September 30) back on the radar before the September low at $76.28 (September 26) and the 2022 low at $74.30 (January 3).

Resistance levels: $90.08 $93.73 $97.65 (4H chart)

Support levels: $86.77 $84.70 $82.62 (4H chart)

DOW JONES

Equities tracked by the three major US stock indices extended the post-CPI rally on Friday and ended the session in multi-week highs.

The optimism around the likelihood of a Fed’s pivot in its policy kept the upside momentum around stocks alive, while another sharp retracement in the greenback also added to the daily gains.

That said, the Dow Jones ended the week on a positive note, reversing the previous pullback. Furthermore, the index advanced in five out of the last six weeks.

All in all, the Dow Jones gained 0.10% to 33,747, the S&P500 advanced 0.92% to 3,992 and the tech-heavy Nasdaq Composite rose 1.88% to 11,323.

Dow Jones closed the week in 3-month highs near 33,800. Further upside could see the August top at 34,281 (August 16) revisited in the short-term horizon ahead of the April peak at 35,492. On the downside, there is an initial support at the key 200-day SMA at 32,541 prior to the November low at 31,727 (November 3) and ahead of the 100- and 55-day SMAs at 31,570 and 31,063, respectively. Down from here emerges the 30,206 level (October 21) before the 2022 low at 28,660 (October 13). The daily RSI hovered around the 68 region.

Top Performers: Walgreen Boots, Nike, Dow

Worst Performers: UnitedHealth, Merck&Co, J&J

Resistance levels: 33,817 34,281 35,492 (4H chart)

Support levels: 32,478 31,727 31,522 (4H chart)

-638039624106580069.png)

-638039611362192610.png)

-638039610723844869.png)

-638039611915284830.png)

-638039625382330515.png)

-638039621220972836.png)

-638039621900433661.png)