Daily Market Updates

15 Nov 2022

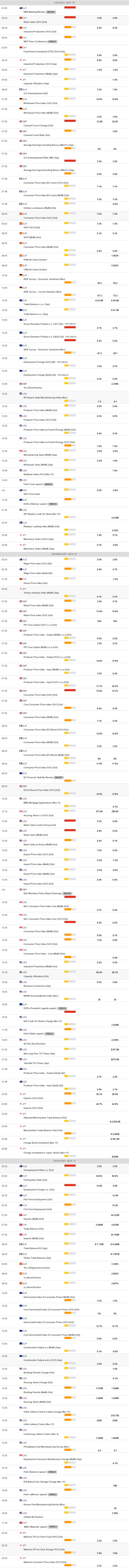

EURUSD

In quite an uneventful session, the greenback managed to regain some poise and drag EUR/USD back to the 1.0270 region, where some decent contention turned up at the beginning of the week. The pair, however, managed to gather some buying interest and trimmed most of that retracement towards the end of the NA session.

The greenback, in the meantime, rebounded from last week’s 3-month lows near 106.30 and staged a marked rebound beyond 107.00 the figure when gauged by the USD Index (DXY).

The better tone in the dollar came amidst a mixed performance in US yields, where the long end advanced marginally vs. pullbacks in the belly and the short end of the curve.

The domestic calendar showed Industrial Production in the broader Euroland expanding more than estimated 4.9% in the year to September.

Across the pond, no data releases were scheduled on Monday, leaving all the attention to the discussion by Vice Chair L.Brainard (permanent voter, dove) on the “Economic Outlook”. Indeed, Brainard advocated for a slower pace of interest rate hikes in the future after she noted that cumulative tightening works with a lag and thus it makes sense to move to a more cautious stance.

If bulls regain control, EUR/USD is then expected to rapidly challenge the August top at 1.0368 (August 10) prior to the critical 200-day SMA, today at 1.0432. Once this area is cleared, the pair could attempt a move to the weekly peak at 1.0614 (June 27) seconded by the June high at 1.0773 (June 9) and the May top at 1.0786 (May 30). On the flip side, interim support aligns at the 100- and 55-day SMAs at 1.0027 and 0.9905, respectively, followed by the weekly low at 0.9730 (November 3) and another weekly low at 0.9704 (October 21). The daily RSI treaded water beyond the 68 level.

Resistance levels: 1.0364 1.0448 1.0488 (4H chart)

Support levels: 1.0271 0.9935 0.9879 (4H chart)

USDJPY

The strong rebound in the greenback appears to have been enough to sponsor an equally robust uptick in USD/JPY, which managed to reclaim the area above the key 140.00 barrier at the beginning of the week.

The sharp bounce in the pair came after bottoming out near 138.40 on Friday, an area last seen back in late August.

The daily advance in the pair came despite another session where US yields lacked traction in any direction across the curve.

From the BoJ, Governor H.Kuroda noted that there is a lot of uncertainty surrounding the country’s economic outlook, adding that the bank continues to closely follow the impact of raw materials inflation and currency movements on households and firms. Kuroda also stressed that fiscal policy must be adaptable in the short term and regarding the FX universe, he reiterated that FX rates should move steadily and in response to economic fundamentals, at the time when he added that it is difficult to imagine a strong dollar lasting forever.

The Japanese calendar was empty on Monday, whereas Q3 GDP figures and Industrial Production results will take centre stage on Tuesday.

USD/JPY remains under pressure and the door seems open to further pullbacks in the near term. That said, the November low at 138.45 (November 11) comes first ahead of the weekly low at 135.80 (August 23) and the key 200-day SMA at 132.84. The loss of the latter exposes a potential drop to the August low at 130.39 (August 2). Just the opposite, bulls face a minor hurdle at the 55-day SMA at 144.86 before the weekly top at 148.84 (October 31) and the 2022 top at 151.94 (October 21). The daily RSI regained upside traction and poked with 32.

Resistance levels: 140.79 142.48 146.45 (4H chart)

Support levels: 138.45 138.05 136.19 (4H chart)

GBPUSD

Following the generalized downbeat mood in the risk-linked galaxy, GBP/USD gave away part of the recent acute climb to the 1.1850 region (November 11) and revisited the boundaries of the 1.1700 mark on Monday.

The daily bounce in the dollar prompted some correction in the riskier assets in combination with a somewhat logical profit-taking sentiment among investors considering the sharp advance seen in past sessions.

Nothing scheduled in the UK docket on Monday left all the attention to the publication of the labour market figures on Tuesday.

Despite the knee-jerk, GBP/USD remains poised to extend the upside momentum in the near term. Against that, the November high at 1.1854 (November 11) emerges as the initial hurdle ahead of the weekly top at 1.1900 (August 26) and prior to the psychological 1.2000 yardstick and the August peak at 1.2293 (August 1). By contrast, the 100-day SMA at 1.1652 should hold the initial test ahead of the 55-day SMA at 1.1359. Further south appears the November low at 1.1142 (November 4) before the weekly low at 1.1059 (October 21) and the October low at 1.0923 (October 12). The daily RSI deflated below the 61 level.

Resistance levels: 1.1854 1.1900 1.2142 (4H chart)

Support levels: 1.1723 1.1593 1.1333 (4H chart)

AUDUSD

Despite the greenback managing to recoup part of the ground lost in recent sessions, AUD/USD was able to cling to the positive territory and keep business above the key 0.6700 neighbourhood on Monday and trade in levels last seen in mid-September.

The mixed performance in the commodity universe saw copper prices halt a 4-session positive streak, while prices of the iron ore flirted with monthly highs near the $93.00 mark per tonne.

Nothing scheduled data wise in Oz on Monday, while the release of the RBA Minutes will be in the centre of the debate on Tuesday.

The November peak at 0.6720 (November 4) emerges as the initial barrier in case bulls maintain control of the sentiment. Once surpassed, AUD/USD could then visit the 7-month resistance line near 0.6750, while a move above this region exposes a probable test of the September high at 0.6916 (September 13) prior to the psychological 0.7000 mark. In the opposite direction, the pair faces initial contention at the weekly low at 0.6386 (November 10) before the November low at 0.6272 (November 3) and the 2022 low at 0.6169 (October 13), all ahead of the psychological 0.6000 level. The daily RSI hovered around the 65 zone.

Resistance levels: 0.6720 0.6747 0.6770 (4H chart)

Support levels: 0.6663 0.6403 0.6386 (4H chart)

GOLD

The daily bounce in the dollar did not prevent prices of the ounce troy of the precious metal to clinch another peak in the area of $1,775 following an earlier drop to the vicinity of $1,750.

In addition, the downtick in yields across the curve also underpinned the third consecutive daily advance in bullion along with some generalized weakness in the risk complex, as many investors cashed up some of their recent strong gains.

Looking at the bigger picture, the yellow metal appears to be propped up by speculation that the Federal Reserve could refrain from implementing jumbo interest rate hikes in the future, turning instead to 25/50 bps raises.

Gold faces an initial up barrier at the November top at $1,775 (November 14, considered the last defense for an assault of the critical $1,800 zone, which just precedes the key 200-day SMA at $1,803 prior to the August peak at $1,807 (August 10). On the other hand, sellers should meet initial support at the temporary 55- and 100-day SMAs at $1,714 and $1,680, respectively, ahead of the 2022 low at $1,614 (September 28). A deeper retracement could see the round level at $1,600 retested prior to the April 2020 low at $1,572 (April 1).

Resistance levels: $1,775 $1,782 $1,807 (4H chart)

Support levels: $1,753 $1,702 $1,669 (4H chart)

CRUDE WTI

Prices of the West Texas Intermediate (WTI) started the week on the back foot and dropped to 2-day lows near $85.70 per barrel on Monday.

Once again, Chinese worries stemming from another surge in COVID cases did the rounds at the beginning of the week and kept the sentiment among traders depressed.

In addition, the rebound in the dollar also weighed on crude oil and the rest of the USD-dubbed assets.

From the OPEC’s monthly report, the cartel cut the 2022 global oil demand to 2.55 mbpd (down 100 kbpd from the previous report) and the 2023 world oil demand to 2.24 mbpd.

A deeper correction in the WTI could well see the November low at $84.74 (November 10) revisited in the short term ahead of the weekly low at $82.10 (October 18) and the key $80.00 mark. A drop below this region could prompt the minor support at $79.16 (September 30) to emerge on the horizon prior to the September low at $76.28 (September 26) and the 2022 low at $74.30 (January 3). In the opposite direction, occasional rebounds should initially target the November high at $93.73 (November 7) before the weekly top at $97.65 (August 30). North from here comes the key 200-day SMA at $98.37 ahead of the psychological $100.00 mark per barrel.

Resistance levels: $90.08 $93.73 $97.65 (4H chart)

Support levels: $85.64 $84.70 $82.62 (4H chart)

DOW JONES

US equities started the week with modest gains and added to the recovery seen last Friday.

Indeed, comments from Vice Chair L.Brainard at a discussion on the “Economic Outlook” appeared to have reinforced the case for a Fed’s pivot sooner rather than later. Brainard deemed it appropriate to slow the pace of the interest rate hikes and move to a more cautious approach.

So, at the beginning of the week, the Dow Jones advanced 0.54% to 33,928, the S&P500 rose 0.36% to 4,007 and the tech-reference Nasdaq Composite gained 0.07% to 11,332.

Dow Jones clinched a new November top at 33,964 (November 14). The surpass of this level could open the door to the August peak at 34,281 (August 16) prior to the April high at 35,492. On the flip side, the key 200-day SMA at 32,537 should offer solid support before the November low at 31,727 (November 3) and ahead of the 100- and 55-day SMAs at 31,603 and 31,092, respectively. The breach of this region cut put a probable visit to the 30,206 level (October 21) back on the investors’ radar ahead of the 2022 low at 28,660 (October 13). The daily RSI flirted with the overbought territory near 69.

Top Performers: Merck&Co, J&J, Visa A

Worst Performers: Microsoft, Walmart, Home Depot

Resistance levels: 33,964 34,281 35,492 (4H chart)

Support levels: 32,478 31,727 31,522 (4H chart)

-638040498470204310.png)

-638040499307268815.png)

-638040498776792095.png)

-638040499653744035.png)

-638040499955365599.png)

-638040500886312695.png)

-638040501139270093.png)